In today’s digital age, the way we handle our finances has undergone a significant transformation. One of the key innovations in this space is the advent of digital wallets, also known as electronic wallets. A digital wallet is a financial transaction application that securely stores your payment information and passwords on any connected device, such as a computer or mobile device. It allows you to make purchases without the need to carry your physical credit or debit cards.

Understanding Digital Wallets

Digital wallets provide a convenient and secure way to store your financial information and make transactions. They offer a range of features, including the ability to store credit card, debit card, and bank account information. Additionally, some digital wallets allow you to store other types of cards, such as gift cards, membership cards, and loyalty cards.

By using a digital wallet, you can simplify your shopping experience and avoid the hassle of carrying multiple physical cards. Instead, you can use your device to pay for purchases. This not only streamlines the payment process but also reduces the risk of losing or misplacing your cards.

How Digital Wallets Work

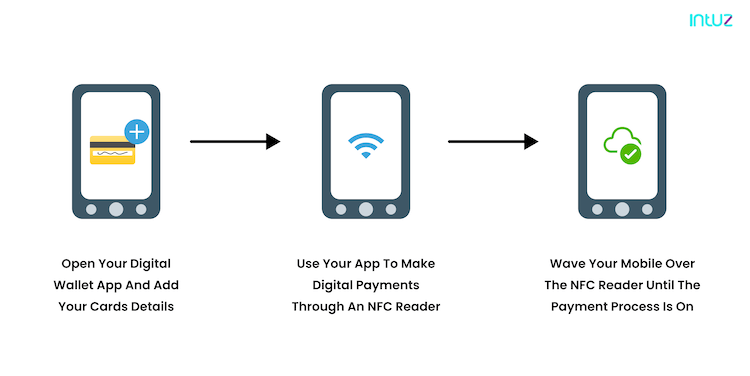

Digital wallets leverage the capabilities of mobile devices to enhance access to financial products and services. These applications eliminate the need to carry a physical wallet by securely storing all your payment information in one place. They use various technologies, such as QR codes, near field communication (NFC), and magnetic secure transmission (MST), to transmit payment data from your device to a point of sale.

QR codes, which are matrix bar codes that store information, are commonly used by digital wallets. To initiate a payment, you simply use your device’s camera and the wallet’s scanning system to capture the QR code. NFC technology enables two smart devices to connect and transfer information using electromagnetic signals, allowing for contactless payments. MST, on the other hand, generates an encrypted field that can be read by point-of-sale terminals, similar to how magnetic card readers work.

When you make a purchase using your digital wallet, the card information you’ve stored in the app is transmitted to the point-of-sale terminal. From there, the payment is routed through credit card networks, banks, and other intermediaries involved in credit and debit card transactions.

Types of Digital Wallets

There are several digital wallets available in the market, each with its own unique features and offerings. Some of the most well-known digital wallets include:

-

Cash App

-

Apple Pay

-

Google Wallet

-

Samsung Pay

-

PayPal

-

Venmo

-

AliPay

-

Walmart Pay

-

Dwolla

-

Vodafone M-PESA

These digital wallets differentiate themselves through various methods. For example, Google’s digital wallet allows users to add funds to their wallet and spend the cash in-store and online at businesses that accept Google payments. Apple Pay, on the other hand, has partnered with Goldman Sachs to issue Apple credit cards and expand its services.

Pros and Cons of Digital Wallets

Like any technology, digital wallets come with their own set of advantages and disadvantages. Let’s explore some of the pros and cons associated with using digital wallets.

Pros of Digital Wallets

-

Limits exposure of financial and personal information: Digital wallets offer enhanced security by storing your credit card information and reducing the need to carry physical cards.

-

Ends the need to carry a physical wallet: By storing your payment information on your mobile device, you can avoid the risk of losing or misplacing your cards.

-

Improves access to financial services: Digital wallets enable people in underserved areas to access financial services that may have been previously unavailable to them.

Cons of Digital Wallets

-

Limited acceptance: Not all merchants accept payment via digital wallets, particularly smaller shops or less-developed areas.

-

Reliant on technology and connectivity: Digital wallets may not work if Bluetooth or WiFi isn’t available, or if your device isn’t charged.

-

Potential security risks: If your mobile device is stolen or hacked, your digital wallet could be vulnerable to identity theft or fraud.

Digital Wallets and Financial Inclusion

Digital wallets play a crucial role in promoting financial inclusion, particularly in areas where access to traditional banking services is limited. These wallets don’t require a physical bank branch and can be used with online-only banks, giving unbanked and underbanked communities access to financial services. This helps bridge the gap and promote broader financial inclusion.

However, it’s important to choose a digital wallet provider that has been vetted and has an established reputation to ensure the security of your financial information. Additionally, not all local businesses may have the infrastructure to accept payments via digital wallets, so it’s important to consider the acceptance of this technology in your preferred shopping locations.

Popular Digital Wallet Examples

Two popular examples of digital wallets are Google Pay and Apple Pay. Google Pay allows users to access their financial products through their devices and make purchases at businesses that accept Google payments. Apple Pay, on the other hand, offers a seamless payment experience through Apple devices and has expanded its services by partnering with financial institutions.

Do You Need a Digital Wallet?

While digital wallets offer convenience and security, they are not a necessity for everyone. However, they provide a convenient way to pay for purchases without carrying physical cards, and they enhance card security by reducing the risk of loss or theft. Ultimately, the decision to use a digital wallet depends on your personal preferences and lifestyle.

Conclusion

Digital wallets are revolutionizing the way we handle financial transactions. By securely storing payment information on our devices, we can simplify the payment process and reduce the need to carry physical cards. While digital wallets offer numerous advantages, it’s important to consider their limitations and potential security risks. By understanding how digital wallets work and evaluating their suitability for your needs, you can make an informed decision about whether or not to embrace this innovative technology.