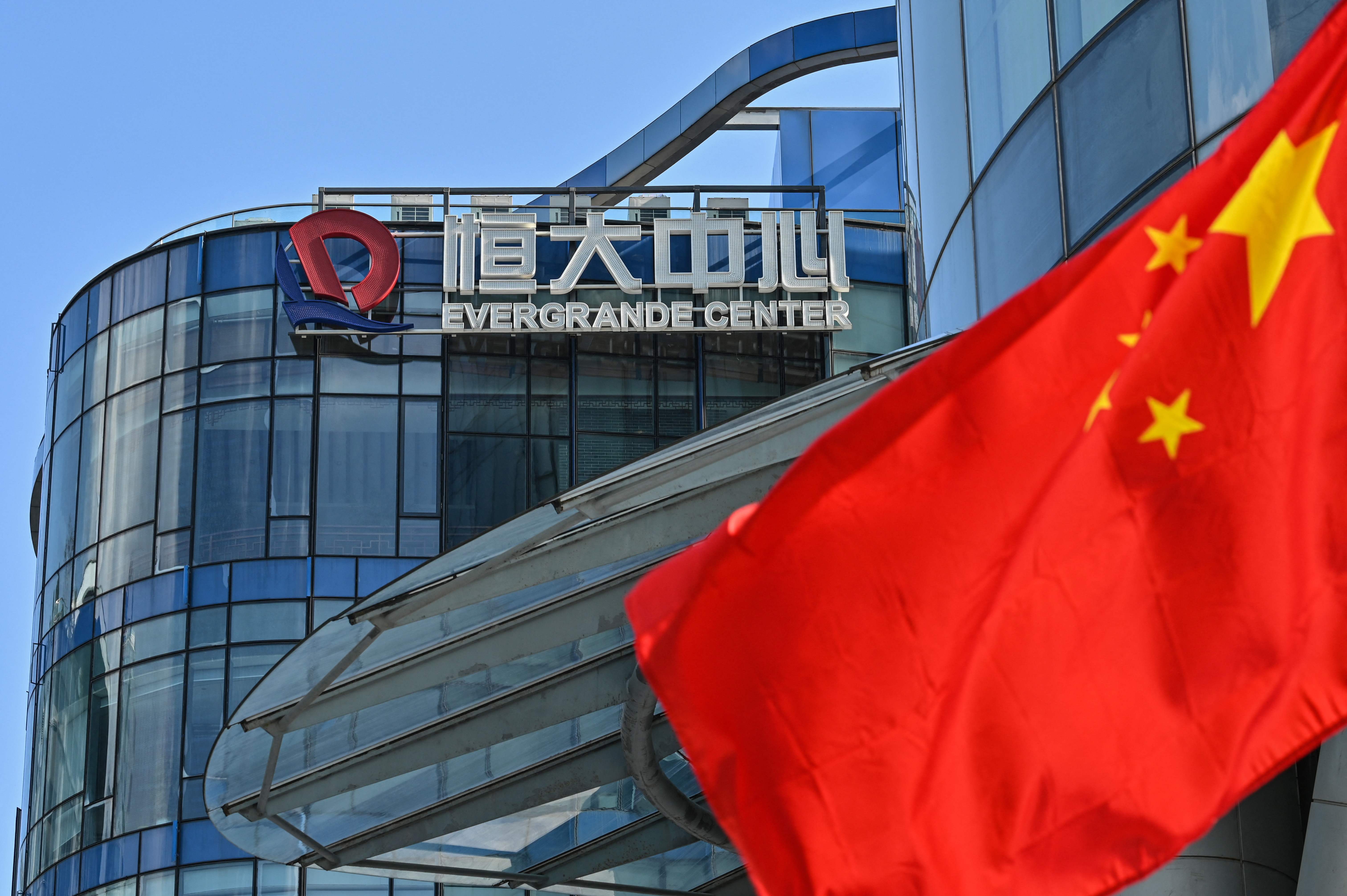

The recent debt crisis of the Evergrande Group in China has sent shockwaves through global financial markets, leaving investors concerned about the potential impact on various industries. One such industry that has garnered significant attention is the entertainment sector, particularly the stock of AMC Entertainment Holdings Inc. In this article, we will explore the potential effects of the Evergrande debt crisis on AMC stock and analyze the factors that could shape its future performance.

Understanding the Evergrande Debt Crisis

The Evergrande Group, one of China’s largest real estate developers, has amassed a staggering debt of approximately $300 billion. This excessive debt burden has sparked fears of a potential destabilization of China’s financial system, which could have far-reaching consequences globally. The collapse of the Hong Kong markets, heavily influenced by Evergrande’s financial troubles, has already reverberated across major stock exchanges, including the New York Stock Exchange.

The Link Between Evergrande and AMC Stock

Given the interconnectedness of global financial markets, it is natural to wonder how the Evergrande debt crisis could impact AMC stock. To comprehend this potential impact, it is crucial to consider the broader context of recent market dynamics. In recent times, retail investors, motivated by social media movements and online communities, have exerted significant buying pressure on heavily shorted stocks. Two notable examples of such stocks are AMC Entertainment and GameStop (GME).

The Role of Retail Investors

Retail investors, often referred to as “apes” within the community, have played a significant role in disrupting traditional market dynamics. By collectively buying shares of heavily shorted stocks, they have caused losses for large hedge funds and short sellers, who had overleveraged their positions. This disruption has led to a historic amount of shorting, according to insiders within the retail community.

The Vulnerability of Hedge Funds

Hedge funds, faced with mounting losses due to the relentless buying pressure from retail investors, find themselves in a precarious position. These institutions have dug themselves into deep holes with overleveraged positions, making it difficult for them to close out their positions efficiently. As the market demands repayment of debt, hedge funds may be forced to liquidate some or all of their positions to meet margin requirements.

The Potential for a Short Squeeze

If a stock market crash were to occur, short sellers with overleveraged positions could face margin calls, which would require them to either inject more capital or liquidate their positions. In the case of heavily shorted stocks like AMC and GME, this could trigger a short squeeze. A short squeeze happens when short sellers rush to cover their positions, driving the stock price even higher.

The Unique Nature of AMC and GME Stocks

It is important to note that stocks like AMC and GME have unique characteristics that differentiate them from the broader market. These stocks have negative beta, meaning their performance tends to move in the opposite direction of the overall market. Therefore, during a stock market crash, these stocks may exhibit resilience or even experience upward movements, despite the downward trend in the broader market.

The Persistence of Shorting and Manipulation

Despite the potential for positive performance during a market crash, stocks like AMC and GME may not always behave as expected. The heavy shorting and manipulation tactics employed by hedge funds have masked the true potential of these stocks. Short sellers have borrowed millions of shares to drive down the stock prices, creating a sense of uncertainty and volatility.

The Impact of Evergrande on U.S. Markets

The collapse of the Hong Kong markets, influenced by Evergrande’s financial troubles, has already had a significant impact on the New York Stock Exchange. The U.S. markets experienced a massive selloff, with almost every stock and cryptocurrency seeing significant declines. If China fails to address the Evergrande crisis adequately, it could potentially lead to a broader stock market crash in the U.S.

The Winter Dip and Future Prospects

Despite the uncertainty surrounding AMC stock, many retail investors in the ape community remain steadfast in their conviction. They view any significant dip in the stock price as an opportunity to increase their positions. The longer retail investors hold onto their shares, the more pressure they exert on short sellers, causing potential losses for hedge funds.

The Importance of Individual Conviction

The decision to hold or sell AMC stock ultimately lies with each individual investor. While there may be differing opinions within the community, it is crucial to maintain conviction in one’s investment decisions. The conviction of diamond hands, as they are often referred to, has been a driving force behind the success of stocks like GME. Their unwavering belief in the potential for short sellers to cover their positions has allowed them to reap significant profits.

Conclusion

The Evergrande debt crisis in China has undoubtedly created a climate of uncertainty in global financial markets. While the full extent of its impact on AMC stock remains uncertain, it is essential to consider the unique dynamics at play. The resilience of stocks like AMC and GME during market downturns, coupled with the potential for a short squeeze, offers hope for retail investors. Ultimately, each investor must weigh the risks and rewards and make informed decisions based on their personal convictions.