Term life insurance is a popular insurance option that provides coverage for a specific period or term. It offers financial protection to your loved ones in the event of your untimely death. This article aims to provide a comprehensive understanding of term life insurance, including its definition, benefits, cost considerations, and how it works.

What is Term Life Insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specific term, typically ranging from 10 to 30 years. Unlike whole life insurance, which provides coverage for the insured’s entire life, term life insurance is temporary and expires at the end of the term.

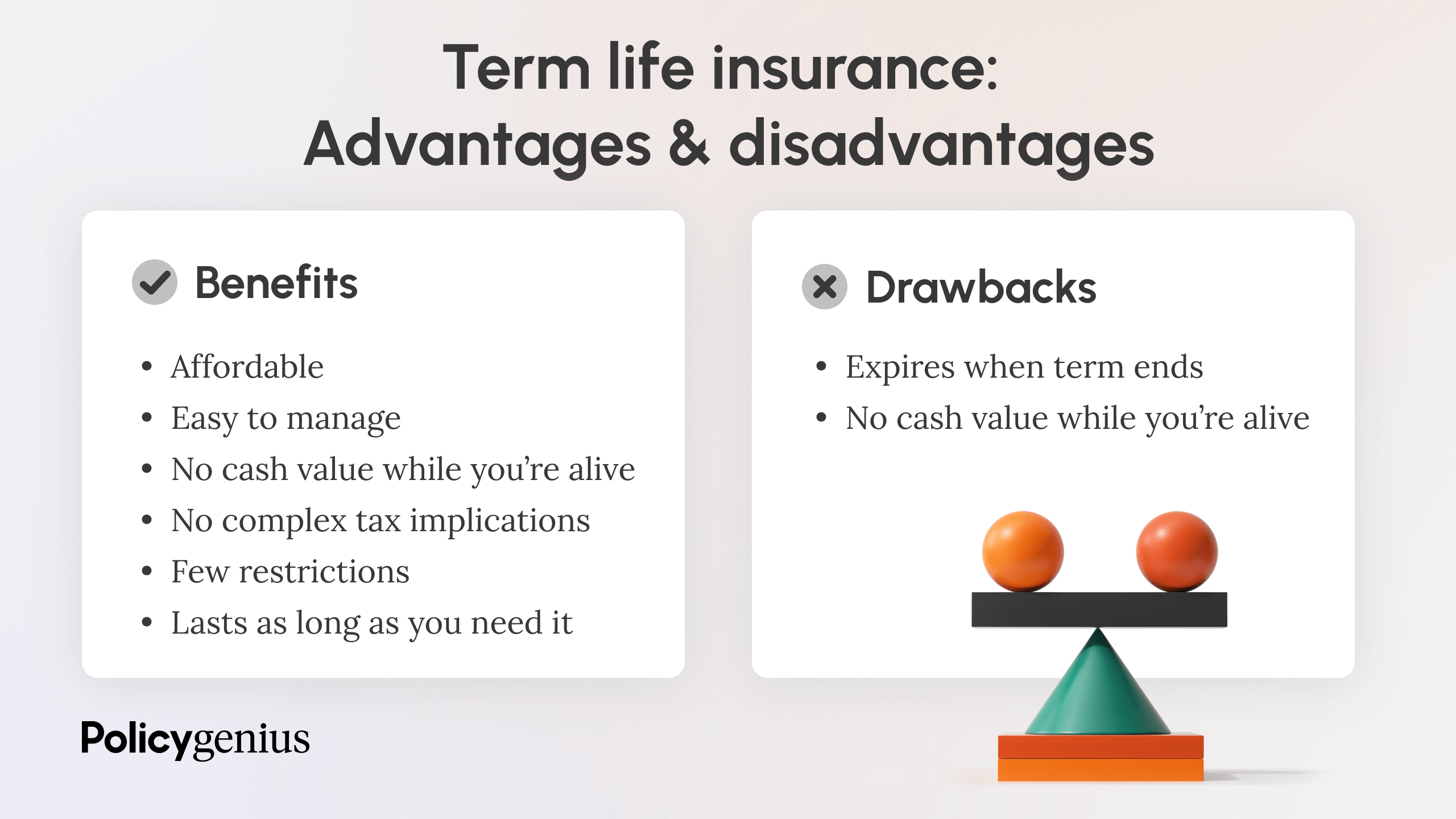

Benefits of Term Life Insurance

Term life insurance offers several key benefits, making it a popular choice for individuals seeking affordable and straightforward coverage. Here are some of the advantages of term life insurance:

-

Affordability: Term life insurance tends to be more affordable compared to other types of life insurance policies. Since it provides coverage for a specific term, the premiums are generally lower.

-

Flexibility: Term life insurance allows you to choose the term length based on your specific needs. You can select a term that aligns with your financial obligations, such as paying off a mortgage or funding your children’s education.

-

Simple Coverage: Term life insurance provides straightforward coverage without any additional components or investment features. This simplicity makes it easier to understand and manage.

-

Income Replacement: Term life insurance can serve as a replacement for lost income in the event of your passing. It ensures that your loved ones can continue to meet their financial obligations and maintain their standard of living.

-

Debt Coverage: If you have outstanding debts, such as a mortgage or loans, term life insurance can help cover these liabilities, ensuring that your family is not burdened with the financial responsibilities.

How Does Term Life Insurance Work?

Understanding how term life insurance works is essential before purchasing a policy. Here is a step-by-step breakdown of the process:

-

Determining Coverage Amount: Start by assessing your financial needs and determining the coverage amount necessary to protect your loved ones adequately. Consider factors such as outstanding debts, future expenses, and income replacement.

-

Choosing the Term Length: Select a term length that aligns with your financial goals. Consider factors such as the duration of your mortgage or the number of years until your children become financially independent.

-

Applying for Coverage: Apply for term life insurance by completing an application and providing the necessary information, such as your age, health history, and lifestyle habits. The insurance company will use this information to assess your risk profile and determine the premium.

-

Underwriting Process: Once you submit your application, the insurance company will review your information and may request additional medical or financial documentation. This underwriting process helps the insurer assess your risk and determine the final premium.

-

Premium Payments: If your application is approved, you will need to pay the premiums to keep the policy in force. Premiums can be paid monthly, quarterly, semi-annually, or annually, depending on your preference.

-

Coverage Period: The term life insurance policy is now in effect, and you are covered for the specified term length. As long as you continue to pay the premiums, the policy remains active.

-

Beneficiary Designation: Designate the person or entity (such as a trust or charity) who will receive the death benefit in the event of your passing. Ensure that you periodically review and update your beneficiary designation to reflect any changes in your circumstances.

-

Death Benefit Payout: If you pass away during the term of the policy, your beneficiaries will receive the death benefit, providing them with financial support during a challenging time.

Factors to Consider When Choosing Term Life Insurance

When selecting a term life insurance policy, it’s crucial to consider various factors to ensure you choose the right coverage for your needs. Here are some key considerations:

-

Coverage Amount: Determine the appropriate coverage amount by evaluating your financial obligations, such as outstanding debts, future expenses, and income replacement needs.

-

Term Length: Choose a term length that aligns with your financial goals and obligations. Consider factors such as the duration of your mortgage, the number of years until retirement, or your children’s educational needs.

-

Premiums: Compare premium rates from different insurance providers to find the most competitive option. Keep in mind that premiums may increase with age, so choosing a longer-term policy may offer more affordable rates in the long run.

-

Financial Stability of the Insurance Company: Research the financial stability and reputation of the insurance company before purchasing a policy. Look for companies with strong ratings from independent rating agencies to ensure they can fulfill their financial obligations.

-

Riders and Additional Coverage: Explore optional riders or additional coverage options that can enhance your policy. Examples include accelerated death benefit riders, which allow you to access a portion of the death benefit if diagnosed with a terminal illness.

Is Term Life Insurance Right for You?

Term life insurance is an excellent choice for many individuals and families. However, it may not be suitable for everyone. Consider the following scenarios where term life insurance may be a suitable option:

-

Young Families: Term life insurance can provide financial protection to young families with dependents. It ensures that your children and spouse are cared for in the event of your untimely death.

-

Mortgage Protection: If you have a mortgage, term life insurance can help cover the outstanding balance, ensuring that your family can continue to reside in their home.

-

Income Replacement: Individuals who are the primary income earners in their families can use term life insurance to replace lost income and maintain their family’s financial stability.

-

Business Owners: Term life insurance can be a valuable tool for business owners, providing funds to cover business debts or facilitate a smooth transition in the event of their passing.

Conclusion

Term life insurance offers an affordable and straightforward solution to protect your loved ones financially. By understanding the basics of term life insurance, including its benefits, how it works, and factors to consider when choosing a policy, you can make an informed decision that aligns with your financial goals and provides peace of mind. Remember to compare quotes from different insurance providers, review policy terms carefully, and consult with a financial professional to ensure you choose the right coverage for your needs.