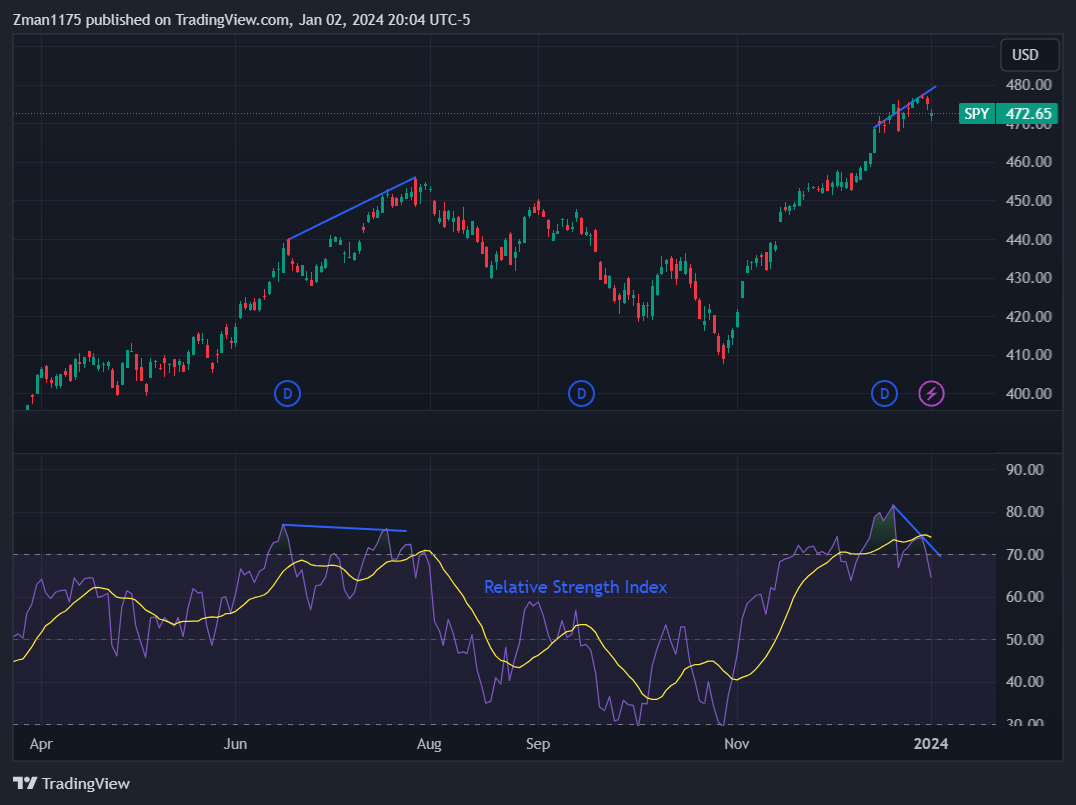

The year 2023 saw stocks soaring to all-time highs, with the S&P 500 gaining nearly 24% throughout the year. However, as we enter 2024, Wall Street’s sentiment about the market’s future is mixed. While some analysts remain bullish, others foresee challenges ahead. In this article, we will delve into Wall Street’s predictions for the stock market in 2024 and explore the factors that may impact its performance.

1. Wall Street’s Divergent Views on Stock Market Performance

As we kick off the new year, Wall Street strategists are divided on the stock market’s future trajectory. While the market ended 2023 on an optimistic note, with a late rally fueled by a more dovish Federal Reserve, many strategists don’t anticipate significant upside for stocks in 2024. The median target among 20 Wall Street strategists tracked by Bloomberg predicts the S&P 500 will finish the year at 4,850, representing a meager 2% increase from its closing value in 20231.

Despite the overall consensus, there is a wide range of opinions among analysts. Goldman Sachs, for instance, has already revised its 2024 target for the S&P 500 from 4,700 to 5,100, reflecting the recent market surge and the shift in the Fed’s stance1. On the other hand, JPMorgan predicts a decline for the benchmark index, with a year-end target of 4,200, indicating a 12% drop in 20241.

2. The Recession Debate: Will Economic Conditions Impact Stocks?

The market’s performance in 2024 may largely hinge on whether a recession occurs. Analysts who believe the economy will avoid a recession or that the recession fears have been overstated forecast the S&P 500 to reach at least 5,000 in 20241. This optimistic camp includes firms such as Oppenheimer, Fundstrat, Goldman Sachs, Deutsche Bank, and Bank of America. Brian Belski, an analyst at BMO, dismisses the possibility of a severe recession, referring to it as a “Chicken Little recession”1. Belski suggests that as long as labor market trends remain steady, there is no cause for concern about a recession1.

However, not all analysts share this positive outlook. Some, like Evercore ISI’s Julian Emanuel, believe that a recession will impact stocks in 2024. Emanuel predicts that stocks will initially decline as the recession sets in but will later rebound as inflation reaches the Federal Reserve’s target1. JPMorgan’s equity strategists also approach the future cautiously, projecting the S&P 500 to close at 4,200 in 2024, highlighting softening consumer trends and potential challenges in the macro backdrop1.

3. The Role of Federal Reserve Policy in Stock Market Performance

A critical factor influencing the stock market’s performance in 2024 is the Federal Reserve’s monetary policy. The Fed currently forecasts three interest rate cuts for the year, but the reasons behind these potential cuts are key to understanding their impact on stocks.

The first reason the Fed may reduce interest rates is if the economy significantly slows down. Lower rates would help ease financial conditions and support economic stability. The second scenario is if inflation drops more rapidly than anticipated, prompting the Fed to cut rates to meet its 2% target. Goldman Sachs, for example, cited this scenario when revising its outlook for stocks1.

4. The Magnificent Seven: A Driving Force Behind the Market

In 2023, the stock market rally was largely driven by seven technology giants known as the “Magnificent Seven.” These companies, including Apple, Alphabet, Microsoft, Amazon, Meta, Tesla, and Nvidia, played a significant role in the market’s gains1. However, towards the end of the year, the rally broadened, and many strategists anticipate this trend to continue in 2024.

Bank of America’s head of US equity and quantitative strategy, Savita Subramanian, predicts broader market leadership in the upcoming year. She expects the S&P 500 to reach an all-time high with a year-end target of 5,000, highlighting the likelihood of a shift away from the dominance of the Magnificent Seven1. Tom Lee, the founder of Fundstrat, also acknowledges the importance of technology and FAANG stocks but suggests that other sectors, such as small caps and financials, may outperform in 20241.

5. Small Caps and Financials: Potential Outperformers in 2024

After a significant surge in 2023, Tom Lee believes that technology stocks may not lead the way in 2024. Instead, he sees potential for small caps and financials to deliver impressive returns. Lee suggests that small caps could rise by 50% and financials by 30% in the upcoming year1. Goldman Sachs also highlights the potential for small-cap stocks to benefit from falling interest rates and improving economic growth expectations1.

In light of the recent outperformance of growth stocks, Goldman Sachs advises investors to be prudent and focus on themes, stable growth, and even dividends within the growth sectors1. Savita Subramanian echoes this sentiment, noting that company-specific fundamentals vary and recent price performance trends may indicate increasingly varied performance in 20241.

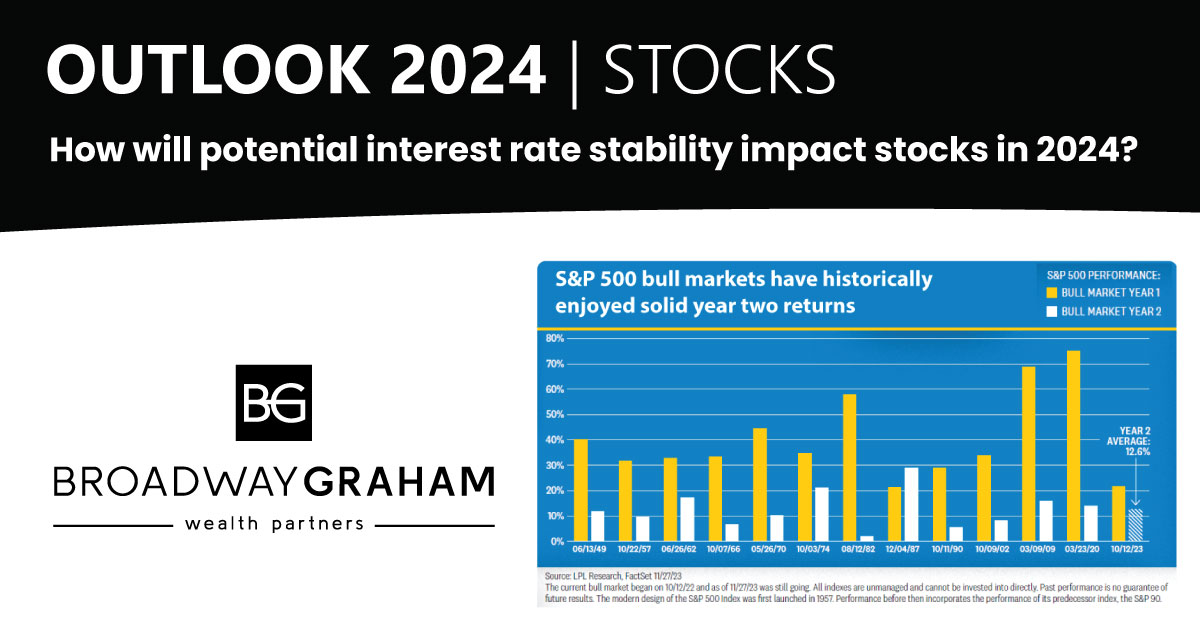

6. Historical Precedents and Market Response to Rate Cuts

The historical relationship between rate cuts and market performance can provide insights into the potential impact on stocks. Goldman Sachs’ analysis reveals that in three out of the last eight interest rate cutting cycles, a recession occurred within 12 months of the first cut. In such cases, stocks generally fared worse than when the economy remained stable following the initial rate cut1.

7. Conclusion: Navigating the Uncertainty

As we enter 2024, the stock market faces a mixture of optimism and caution on Wall Street. While some analysts anticipate limited upside for stocks, others remain bullish or cautiously optimistic. The occurrence of a recession, the Federal Reserve’s policy decisions, and the performance of different sectors will be key factors shaping the market’s trajectory.

Investors should closely monitor economic indicators, labor market trends, and the Fed’s actions to make informed decisions. Diversification across sectors, including potential opportunities in small caps and financials, can help navigate the uncertainties of 2024.