State Farm is one of the leading insurance companies in the United States, offering a wide range of coverage options for car owners. If you’re considering getting car insurance from State Farm, you might be wondering how much it will cost you. The price of State Farm car insurance depends on several factors, including your location, the type of car you drive, and your age. In this article, we will explore the various factors that contribute to the cost of State Farm car insurance and provide you with some insights on how to save money on your premiums.

Understanding State Farm: The Basics

Before we delve into the cost of State Farm car insurance, let’s take a moment to understand the company itself. State Farm is the largest private passenger auto insurer in the country, but they also offer other insurance products such as homeowners policies, renters insurance, and recreational vehicle insurance. They have a vast network of 18,000 agents and operate in all 50 states and Washington, D.C. If you value the convenience of interacting with local agents and need multiple forms of insurance coverage, State Farm could be an excellent option for you.

Types of Car Insurance Offered by State Farm

State Farm provides various types of car insurance coverage to meet the specific needs of their customers. In addition to liability, collision, and comprehensive coverage for personal passenger vehicles, they offer specialized forms of car insurance. Let’s take a closer look at some of these offerings:

-

Commercial Auto Insurance: If you own a business and use company-owned vehicles, State Farm’s commercial auto insurance provides protection in case of accidents. They also offer Employers Non-Owned Liability coverage, which covers employees who use their personal vehicles for business purposes.

-

Classic Car Insurance: State Farm offers coverage for classic or antique cars. This type of policy includes standard coverage like liability, collision, and comprehensive. To determine if your vehicle qualifies as a classic car, you can consult State Farm’s website.

-

Roadside Emergency Service: State Farm’s car insurance policies include coverage for roadside assistance, such as battery jump-starts, tire changes, locksmith services, and other emergency repairs.

-

Rental Car and Travel Expenses Coverage: In addition to rental car coverage, State Farm goes above and beyond by providing coverage for lodging if your car becomes undrivable due to a collision or natural disaster.

-

Rideshare Insurance: If you work for a ride-sharing company like Uber or Lyft, State Farm offers a ride-sharing insurance policy as an extension of your personal insurance coverage.

Factors Affecting State Farm Car Insurance Cost

Now, let’s get to the main question: how much does State Farm car insurance cost? The average annual cost for a State Farm car insurance premium is $1234, which is slightly below the national average. However, keep in mind that this average can vary based on different demographics and factors specific to your situation.

Here’s a breakdown of what drivers in specific demographics can expect to pay, on average, for a State Farm policy:

-

Single 25-Year-Old Male: $1468.63 annually

-

Single 25-Year-Old Female: $1330.05 annually

-

Married 35-Year-Old Male: $1204.67 annually

-

Married 35-Year-Old Female: $1204.67 annually

-

Married 60-Year-Old Male: $1098.01 annually

-

Married 60-Year-Old Female: $1098.01 annually

These rates will also vary depending on the state you live in and the type of vehicle you drive. To give you a better idea of how much coverage will cost you, let’s examine the average rates based on different levels of coverage:

-

Low Level of Coverage: $1143.10 annually

-

Medium Level of Coverage: $1234.01 annually

-

High Level of Coverage: $1325.66 annually

Remember, these rates are averages, and your personal driver profile will influence the final cost of your State Farm car insurance policy.

Discounts Offered by State Farm

Although State Farm’s rates may be slightly higher than some of their competitors, they offset this by offering several generous discounts. By taking advantage of these discounts, you can reduce the overall cost of your car insurance premiums. Here are some of the discounts that State Farm provides:

-

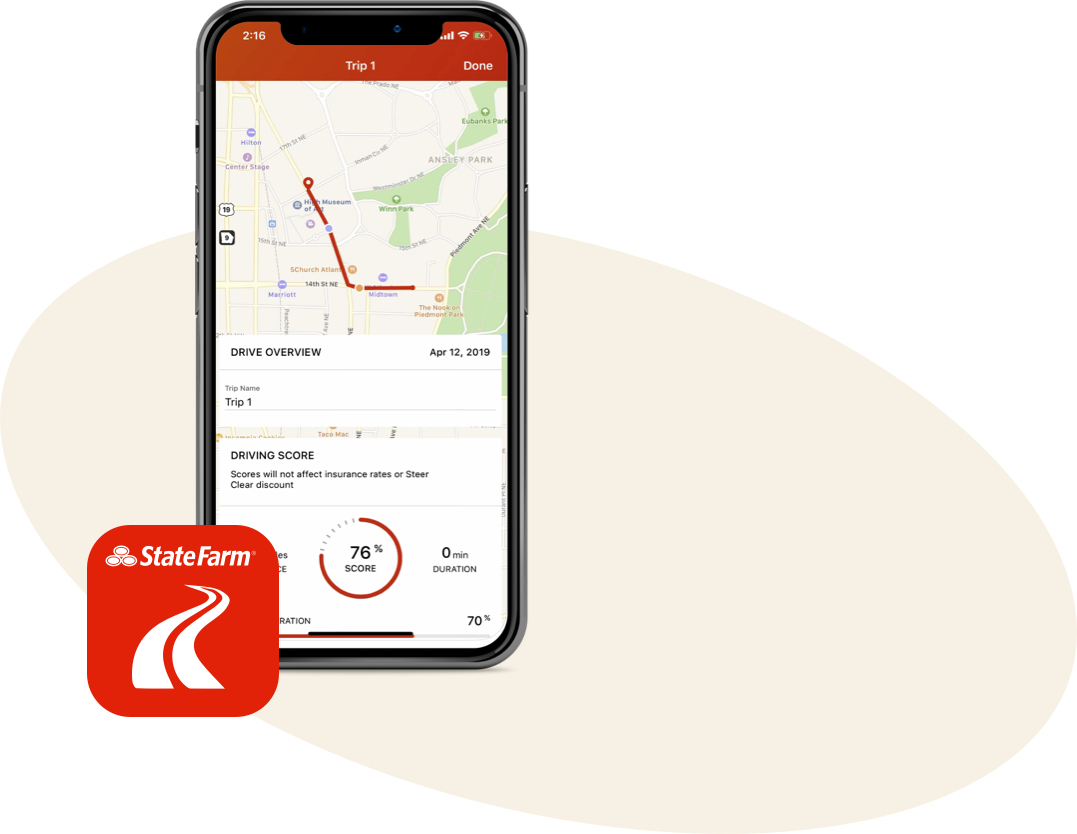

Drive Safe & Save: State Farm’s Drive Safe & Save program allows drivers to use a phone app to track their mileage and driving habits. By demonstrating safe driving habits, you can save up to 30 percent on your premiums.

-

Steer Clear Driver Program: This program is specifically designed for drivers under the age of 25. By completing a driver training refresher course and maintaining a clean driving record, young drivers can qualify for lower premiums.

-

Accident-Free Discount: If you go without having an at-fault accident for three years, State Farm rewards you with a reduction in rates.

-

Defensive Driving Discount: By completing a defensive driving course, you can further reduce your car insurance premiums.

-

Good Student Discount: High school and college students under the age of 25 who maintain a GPA of 3.0 or higher can qualify for this discount.

-

Safe Vehicle Discount: If your vehicle is equipped with safety features such as airbags or other passive restraint systems, you may be eligible for additional savings.

-

Bundling Discounts: State Farm offers significant discounts for customers who insure multiple vehicles or bundle their car insurance with other policies, such as homeowners or renters insurance.

By taking advantage of these discounts, you can ensure that you’re getting the best possible price for your State Farm car insurance policy.

Conclusion

State Farm is a reputable insurance company that offers a wide range of car insurance options to meet the needs of different customers. While the cost of State Farm car insurance may vary depending on factors like your location, type of vehicle, and driver profile, the company provides various discounts to help you save money on your premiums. By understanding your insurance needs, exploring the available coverage options, and applying for applicable discounts, you can find a State Farm car insurance policy that fits your budget and provides the necessary protection. Remember to review your policy regularly and compare rates to ensure you’re getting the best possible deal.