America is facing a mental health crisis, with depression, anxiety, substance use, and suicide rates skyrocketing. However, a significant obstacle preventing individuals from accessing the care they need is the role of insurance companies. This article delves into the ways insurance companies exacerbate the mental health crisis, including inadequate coverage, denial of doctor-prescribed care, and the resulting burden on emergency rooms. By understanding the contributing factors, we can advocate for reforms that prioritize mental health care and ensure that insurance companies fulfill their obligations to policyholders.

Limited Access to Care

One of the key issues plaguing the mental health care system is the lack of access to specialized care for individuals with behavioral health conditions. Shockingly, only 30.7 percent of individuals diagnosed with a behavioral health condition in 2021 received specialty care despite having commercial insurance coverage1. This means that more than two-thirds of policyholders with a known diagnosis were paying for coverage they weren’t receiving.

Ghost Networks and Out-of-Network Costs

Making an appointment with a doctor or therapist is often an arduous task due to what are commonly known as “ghost networks.” Insurance companies’ provider directories are riddled with duplicates, retirees, and providers who are not accepting new patients. The lack of in-network providers forces individuals to seek care out of network, resulting in exorbitant out-of-pocket costs1. In 2021, the average out-of-pocket cost for an hour-long psychotherapy session reached $174, a significant barrier to access1.

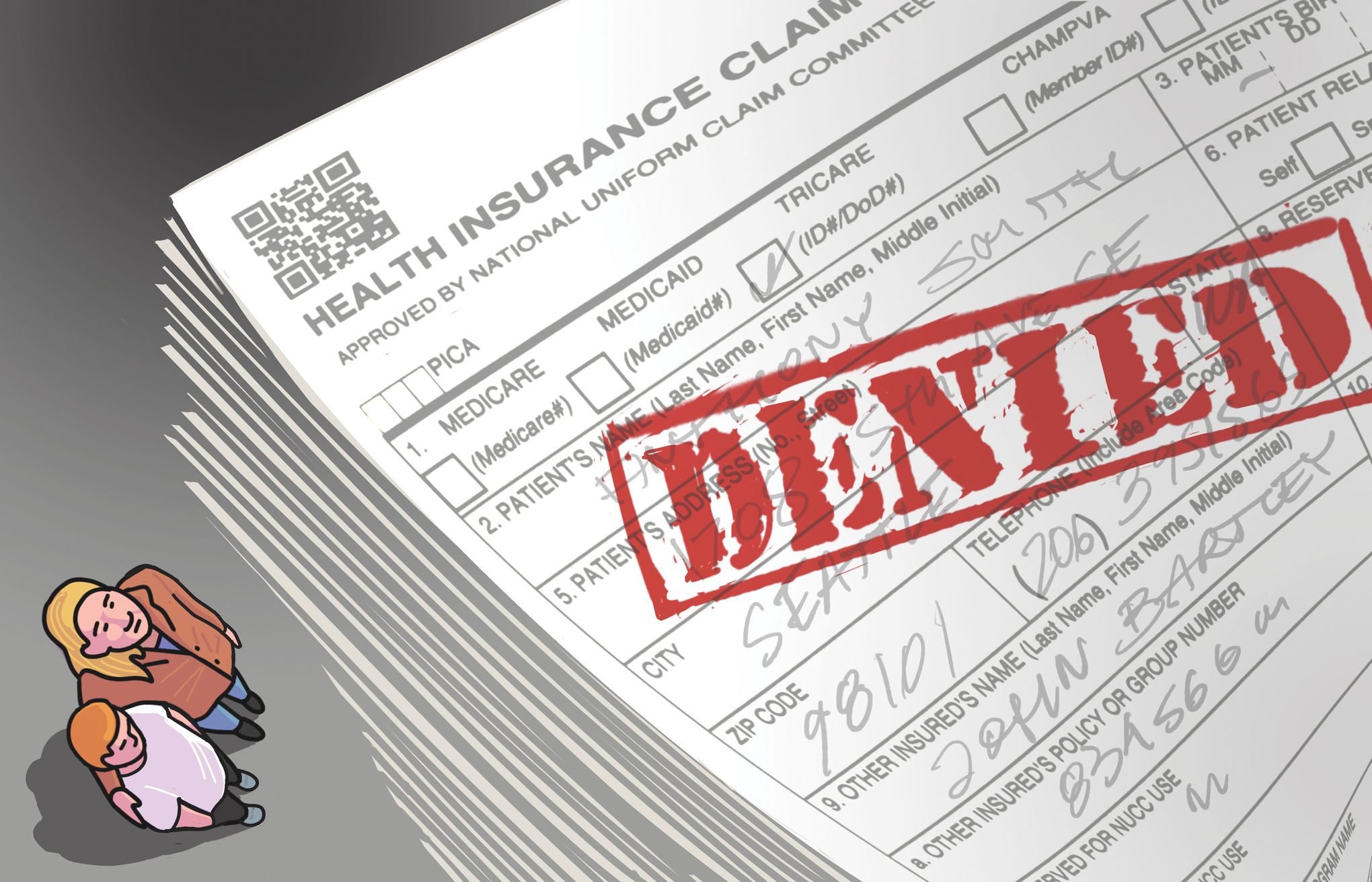

Denial of Doctor-Prescribed Care

Even if individuals manage to see a provider who prescribes treatment, insurance companies frequently scrutinize and deny the recommended care. This interference in the doctor-patient relationship is driven by profit maximization. Insurers employ various tactics such as requiring prior authorization, implementing “fail first” policies, prematurely cutting treatments short, and treating symptoms rather than underlying conditions1. These denials hinder individuals from receiving the care they need, exacerbating their mental health conditions.

Emergency Room Trauma

The barriers to outpatient care imposed by insurance companies often result in individuals seeking help in emergency rooms. The inability to find a doctor or spending hours appealing denials of care not only inconveniences patients but also traumatizes them further. This overburdens emergency departments, increasing the financial burden on hospitals and taxpayers1. Insurance companies must be held accountable for their role in driving individuals to emergency care due to their failure to provide adequate mental health services.

Insurance Companies’ Contributions to Workforce Shortages

Insurance companies are quick to blame workforce shortages for the lack of mental health care accessibility, conveniently ignoring their own contributions to the problem. By setting below-market reimbursement rates and imposing burdensome administrative processes, insurers push providers out of network and perpetuate the shortage1. These tactics ultimately hinder individuals from accessing the care they need and deserve.

Urgent Need for Reform

In order to bridge the mental health treatment gap, policymakers must enforce existing laws and demand proper coverage from insurance companies. The following reforms are crucial to expanding mental health care access:

- Coverage for Doctor-Prescribed Care: Insurers should be required to cover care prescribed by a healthcare professional, ensuring that individuals receive the treatments recommended by their doctors.

- Accurate Provider Directories: Insurance companies must maintain up-to-date and accurate provider directories, allowing individuals to easily find in-network mental health providers.

- Coverage for Out-of-Network Costs: When insurance companies fail to provide an adequate network, they should be responsible for covering out-of-network costs incurred by policyholders seeking necessary care.

- Elimination of Arbitrary Limits on Care: Insurers should not impose arbitrary limits on mental health care, preventing individuals from receiving the appropriate duration and intensity of treatment.

Public Support for Reform

Reforming the mental health care system has widespread public support across state and party lines. Polls consistently show that voters want lawmakers to take action and expand access to mental health treatment1. The majority of voters support reforms such as coverage for doctor-prescribed care, accurate provider directories, coverage for out-of-network costs, and the removal of arbitrary limits on care1. Policymakers who prioritize mental health reform are likely to be rewarded at the ballot box, as 76 percent of voters say they are more likely to support candidates who advocate for these reforms1.

Conclusion

Insurance companies play a significant role in exacerbating the nation’s mental health crisis by limiting access to care and denying doctor-prescribed treatments. Through reforms that prioritize mental health care and hold insurance companies accountable, we can start to bridge the treatment gap. Policymakers must enforce existing laws and demand proper coverage, while voters have the power to support candidates committed to expanding mental health access. Together, we can create a system that ensures everyone receives the mental health care they deserve.