Digital finance has the potential to be a game-changer for the unbanked poor in developing Asia. With over 2 billion unbanked adults in the world, half of whom reside in developing Asian countries, there is a pressing need to promote financial inclusion and provide access to formal financial services for marginalized groups such as women and the self-employed. Several countries in the region, including India, Indonesia, Mongolia, Myanmar, Pakistan, and the Philippines, have recognized this need and are actively promoting digital financial services as part of their national strategies for financial inclusion.

According to McKinsey & Co., over 700 million consumers in Asia now regularly use digital banking services. While this represents significant progress, the penetration of digital banking is still relatively low in developing Asia. The challenge lies in convincing poor households and small businesses of the value-add of digital financial services. There are both supply-side and demand-side factors contributing to this hesitation.

Supply-side Challenges

One of the key challenges on the supply side is the lack of basic knowledge about digital financial services among potential users. During field research conducted in the Philippines, low-income managers and shopkeepers expressed a strong preference for cash as the most trusted form of payment. They were hesitant to adopt digital options such as cards and mobile payments due to a lack of understanding about how these services work. Marketing failures by digital financial service providers were also cited as a constraint. Computer-generated marketing messages often fail to resonate with low-income individuals, and cold-calling can make them feel uncomfortable.

Demand-side Constraints

Poor households and small businesses in developing Asia rely heavily on cash transactions and informal ways of transacting. They often feel that their income is too unstable to warrant using formal financial services and prefer to rely on cash for their day-to-day needs. The Financial Diaries methodology, which tracks the cash and non-cash flows of poor households, has highlighted the need for financial products that are better adapted to the real-life needs of the poor. To encourage the adoption of digital finance, it is essential to understand the specific problems and needs of poor customers and provide concrete solutions that can improve their lives.

Unlocking the Potential of Mobile Money

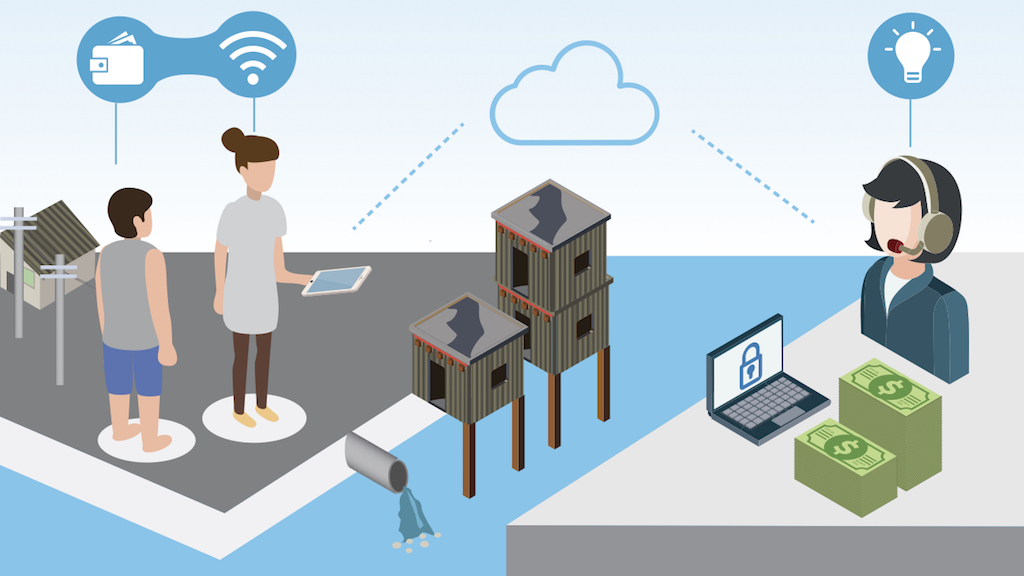

Mobile money has the potential to significantly improve the lives of the poor, as demonstrated by the success of M-Pesa in Kenya. It allows for low-cost, fast, safe, and easy transactions without the need to visit physical branches, thus encouraging a cashless society. However, the full potential of mobile money is not being realized in developing Asia. Only 1% of people with access to formal financial services have a mobile money account, and even among those who have one, half of the accounts are inactive and half of the active accounts are empty.

One reason for this underutilization of mobile money is the lack of understanding about the concept of stored value. Many people view savings simply as unspent money and prefer to keep their funds in cash rather than in digital form. Cash is widely accepted and trusted, while digital money is not yet seen as a reliable store of value. This is particularly evident among poor households in developing Asia.

Rising Mobile Penetration Rates

Despite these challenges, mobile adoption is on the rise in Asia-Pacific. The region had 2.7 billion mobile subscribers in 2016, and this number is projected to reach 3.1 billion by 2020, accounting for three-quarters of the population. This trend is led by countries like China and India, but Southeast Asian nations such as Indonesia, Malaysia, Myanmar, and the Philippines have also shown high smartphone adoption ratios, with over 50% of households owning a smartphone.

To illustrate the potential of digital financial services for the poor, let’s consider a real-life example from the Philippines. A family living in a poor community on the outskirts of Metro Manila earns around Php500-600 ($10-12) per day. Despite their challenging living conditions, they own a smartphone and a tablet which their children use for online studying since they cannot afford to buy books. This example highlights the immense potential for delivering digital financial services to the poor, given their high mobile penetration rates.

Overcoming Challenges and Realizing the Benefits

To ensure the success of digital finance in serving the unbanked poor in developing Asia, several steps need to be taken. First and foremost, there is a need to address the lack of knowledge and understanding about digital financial services among potential users. Financial service providers should invest in education and awareness campaigns that clearly communicate the benefits and functionalities of digital finance in a way that resonates with the target audience.

Secondly, financial products and services should be tailored to meet the real-life needs of the poor. The Financial Diaries methodology has provided valuable insights into the financial behaviors and usage patterns of poor households, highlighting the need for customized solutions. By understanding the specific challenges faced by the poor and developing products that address these challenges, digital financial service providers can better serve this underserved segment of the population.

Furthermore, building trust and confidence in digital financial services is crucial. This can be achieved through transparent and secure platforms that protect users’ funds and personal information. Collaborations between digital finance providers, governments, and regulatory bodies can help establish regulatory frameworks that ensure consumer protection and promote trust in the system.

In conclusion, digital finance has the potential to empower the unbanked poor in developing Asia by providing them with access to formal financial services. However, to fully realize this potential, supply-side challenges such as lack of knowledge and marketing failures need to be addressed. Additionally, demand-side constraints, including the preference for cash and the need for tailored financial products, must be overcome. By leveraging the rising mobile penetration rates in the region and developing solutions that meet the specific needs of the poor, digital finance can play a transformative role in improving the lives of the unbanked population in developing Asia.