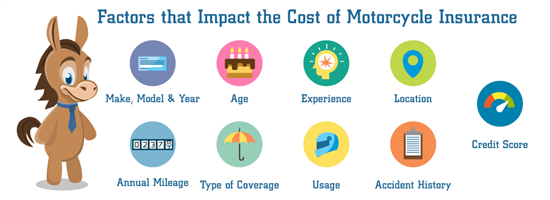

Motorcycle insurance is an essential investment for riders to protect themselves and their bikes in case of accidents or other unforeseen events. However, the cost of motorcycle insurance can vary significantly from rider to rider. Insurance companies consider several factors when determining the premium for motorcycle insurance. In this article, we will explore the key factors that influence the cost of motorcycle insurance and how you can potentially reduce your premiums.

Age and Riding Experience

One of the primary factors that insurance companies consider when calculating motorcycle insurance premiums is the age of the rider. Younger riders, especially those in their teens or early twenties, generally have higher insurance premiums compared to older, more experienced riders. This is because younger riders are statistically more likely to be involved in accidents due to their relative lack of experience on the road.

In addition to age, insurance companies also take into account the rider’s riding experience. Riders with several years of experience and a clean riding record are often eligible for lower insurance rates. Insurance providers view experienced riders as less risky and more likely to have developed safe riding habits.

Type of Motorcycle

The type of motorcycle you ride can significantly impact the cost of your insurance premiums. Insurance companies take into account factors such as the make, model, and engine size of your bike when calculating your premiums. Generally, high-performance or sport motorcycles are associated with higher insurance rates due to their increased speed capabilities and higher risk profile. On the other hand, cruisers or standard bikes tend to have lower insurance rates.

Usage and Mileage

Insurance companies also consider how you use your motorcycle and the number of miles you typically ride when determining your insurance premiums. If you primarily use your motorcycle for commuting to work or for business purposes, you may be subject to higher premiums compared to riders who use their motorcycles for recreational or occasional purposes only. This is because riders who use their motorcycles for commuting are more likely to encounter heavy traffic and potentially higher accident risks.

Location

The location where you reside and primarily ride your motorcycle can also influence the cost of your insurance. Insurance rates can vary based on factors such as population density, crime rates, and accident rates in your area. If you live in an urban area with higher traffic congestion or a higher incidence of motorcycle theft or accidents, you can expect higher insurance premiums.

Coverage Options

The type and level of coverage you choose for your motorcycle insurance will also impact your premiums. Insurance policies typically offer different levels of coverage, including liability-only coverage and comprehensive coverage. Liability-only coverage is generally less expensive as it provides coverage for damages and injuries caused to others in an accident. On the other hand, comprehensive coverage provides additional protection for theft, vandalism, and other non-accident-related damage, but comes with higher premiums.

Deductible Amount

The deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can help lower your insurance premiums. However, it’s important to consider your financial situation and ability to pay the deductible in the event of a claim. While a higher deductible may result in lower premiums, it also means you’ll have to pay more upfront if you need to make a claim.

Claims History

Your personal claims history, including any previous motorcycle accidents or traffic violations, can impact your insurance rates. Insurance companies consider claims history as an indicator of risk. Riders with a clean claims history and no previous accidents or violations are generally considered lower risk and may qualify for lower premiums.

Credit History

In some regions, insurance companies also consider credit history as a factor in determining insurance premiums. A good credit score may result in lower insurance rates, as it indicates financial responsibility and lower risk. On the other hand, a poor credit score may lead to higher insurance premiums.

Additional Riders

If you add additional riders to your motorcycle insurance policy, such as a spouse or teenage child, it can impact your premiums. Young or inexperienced riders are generally associated with higher risk, and adding them to your policy may result in increased premiums. It’s important to consider the potential impact on your premiums before adding additional riders to your policy.

Shop Around for the Best Rates

It’s important to note that each insurance company has its own underwriting guidelines and may weigh these factors differently. To find the most suitable coverage at an affordable premium based on your specific circumstances, it’s advisable to shop around and compare quotes from multiple insurers. Working with a licensed insurance professional can also help you navigate the complexities of motorcycle insurance and assist you in finding the best rates.

In conclusion, several factors influence the cost of motorcycle insurance. Age, riding experience, type of motorcycle, usage and mileage, location, coverage options, deductible amount, claims history, credit history, and additional riders all play a role in determining insurance premiums. By understanding these factors and taking steps to mitigate risks, such as maintaining a clean riding record and choosing the right coverage, you can potentially reduce your motorcycle insurance premiums while ensuring adequate protection.