1. Introduction

Welcome to our comprehensive guide on business lines of credit! As a small business owner, you may have encountered situations where you needed flexible financing options to manage cash flow problems, seize time-sensitive opportunities, or address working capital needs. A business line of credit can be a valuable tool in such scenarios, allowing you to borrow funds up to a predetermined credit limit, repay what you use, and borrow again as needed. In this guide, we will explore the ins and outs of business lines of credit, their benefits, and the top lenders in the industry.

2. What is a Business Line of Credit?

A business line of credit is a type of financing that provides you with access to a specific amount of money from a lender. Unlike a traditional term loan, where you receive a lump sum upfront, a line of credit allows you to borrow funds on an as-needed basis, up to your credit limit. You only pay interest on the amount you utilize. The lender determines your credit limit based on factors such as your credit score and business needs. This flexible form of financing can serve as a lifeline for small businesses, offering quick access to funds without undergoing the lengthy application process associated with traditional loans.

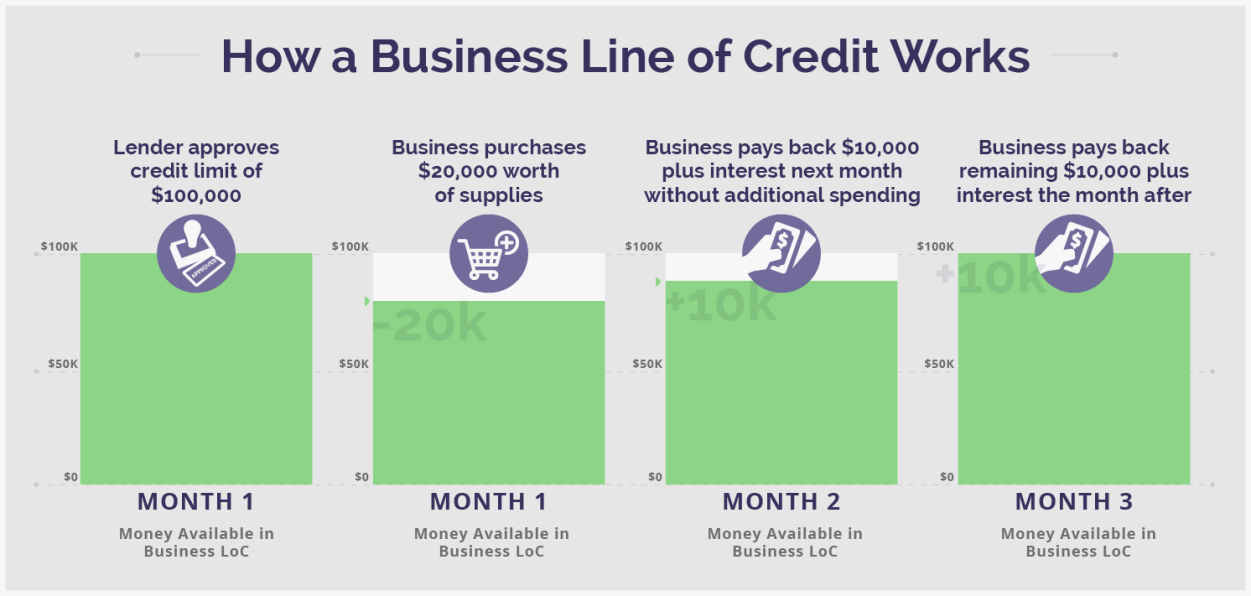

3. How Does a Business Line of Credit Work?

While business lines of credit are often lumped together with business loans, they function differently. With a term loan, you receive a fixed sum of money that you repay over a predetermined period. A line of credit, on the other hand, provides you with a credit limit that you can draw from as necessary. You only pay interest on the borrowed amount, making it a cost-effective solution for managing short-term financing needs.

A business line of credit allows you to borrow and repay repeatedly within the term of the credit line. This revolving credit feature eliminates the need to reapply for financing every time a new need arises. It works similarly to a business credit card, but lines of credit are typically more suitable for larger working capital expenses. Many businesses find it beneficial to have both a line of credit and a credit card to enjoy maximum financial flexibility.

4. Benefits of a Business Line of Credit

Business lines of credit offer numerous advantages for small businesses. Here are some key benefits:

a. Flexibility: A line of credit provides you with the freedom to use funds as needed, giving you the flexibility to address various business needs. Whether you need to purchase equipment, hire staff, invest in marketing campaigns, or manage cash flow fluctuations, a line of credit can be an invaluable resource.

b. Cost-Effective: Unlike term loans where you pay interest on the entire loan amount, lines of credit only charge interest on the funds you utilize. This cost-effective structure allows you to save money by avoiding unnecessary interest payments on unused credit.

c. Repeat Borrowing: With a line of credit, you can borrow, repay, and borrow again within the predetermined credit limit. This revolving credit feature provides ongoing access to funds without the need for constant reapplication, making it ideal for businesses with fluctuating financing needs.

d. Quick Access to Funds: When you have a line of credit in place, you can access funds quickly and efficiently whenever the need arises. This speed can be crucial in seizing time-sensitive opportunities or addressing unexpected expenses.

e. Building Credit History: Regularly utilizing and repaying your line of credit can help you establish and improve your business credit history. This can be beneficial when applying for future financing or negotiating better terms with lenders.

5. How to Use a Business Line of Credit

One of the advantages of a business line of credit is the versatility it offers in meeting various business needs. Here are some common uses for a line of credit:

a. Purchasing Equipment or Inventory: A line of credit can provide the necessary funds to purchase essential equipment or maintain an optimal level of inventory. By having access to readily available credit, you can ensure your business operations run smoothly.

b. Hiring Staff and Making Payroll: Managing payroll expenses is crucial for any business. A line of credit can help bridge any temporary gaps in cash flow, ensuring you can meet your payroll obligations on time and avoid any disruptions.

c. Taking Advantage of Time-Limited Deals: Opportunities often arise in business where acting quickly can yield significant advantages. A line of credit allows you to seize time-limited deals, discounts, or bulk purchase opportunities that can benefit your business.

d. Creating Marketing Campaigns: Marketing initiatives are essential for promoting your business and attracting customers. A line of credit can provide the necessary funds to launch effective marketing campaigns, helping you reach a wider audience and drive sales.

e. Smoothing Over Cash Flow Issues: Many businesses experience fluctuations in cash flow due to seasonality or delayed customer payments. A line of credit can help bridge these gaps, ensuring you have sufficient working capital to cover expenses during lean periods.

f. Tiding Over Seasonal Profit Changes: For businesses with seasonal fluctuations in revenue, a line of credit can help manage cash flow during periods of lower profitability. It provides a safety net to cover expenses until your business enters a more profitable season.

For more detailed information on obtaining and utilizing a business line of credit, refer to our comprehensive guide on how a business line of credit works.

6. Best Business Lines of Credit: Overview

Finding the right lender for your business line of credit is crucial. While Lendio ranks as the top lender overall, there are other reputable lenders worth considering. Here’s an overview of the best lenders in the industry:

a. Lendio: The Best Business Line of Credit Overall

Key Features:

-

Partnership with over 75 lenders, increasing your chances of securing funding

-

Competitive interest rates and borrower requirements

-

Lendio’s lending marketplace allows you to compare offers and choose the best option for your business

Lendio stands out as our top-rated lender due to its unique lending marketplace approach. Instead of being a direct lender, Lendio partners with multiple lenders, allowing you to access a wide range of line of credit options. By submitting a single online application, Lendio matches you with lenders you qualify for, giving you the opportunity to compare offers and choose the most favorable terms. This marketplace model, combined with competitive interest rates and borrower requirements, makes Lendio an excellent choice for most small businesses.

b. Backd: The Best for Flexible Repayment

Key Features:

-

Flexible repayment terms of six months or 12 months

-

Automatic credit reload as you pay off your balance

-

Fast application process with funding available within 24 hours

Backd offers a line of credit with a unique focus on flexibility and speed. With repayment terms of six or 12 months, Backd allows you to customize your repayment schedule according to your business needs. As you pay off your balance, your credit reloads automatically, eliminating the need to contact an agent for additional funds. The application process is quick and straightforward, with funding available within 24 hours. However, keep in mind that Backd does not fund certain industries, so be sure to check their eligibility criteria before applying.

c. Bluevine: The Best for Low Rates

Key Features:

-

Competitive starting interest rates, comparable to traditional banks

-

Same or next-day funding for qualified borrowers

-

Business credit bureau reporting to help build credit history

If you’re looking for low rates on your business line of credit, Bluevine is a top contender. With starting interest rates as low as 4.8%, Bluevine offers rates comparable to traditional banks while providing the convenience of an online lender. While Bluevine has higher borrower requirements compared to some other lenders, it offers same or next-day funding for qualified borrowers. Additionally, Bluevine reports to business credit bureaus, allowing you to establish and improve your business credit history.

d. OnDeck: The Best for Repeat Borrowers

Key Features:

-

Discounts on future financing for repeat borrowers

-

Fast funding times, with credit bureau reporting

-

High starting APR and borrower requirements

OnDeck differentiates itself by offering discounts on future financing for repeat borrowers. If you anticipate needing additional funding beyond your initial line of credit, OnDeck’s repeat borrowing discount can be advantageous. Additionally, OnDeck boasts fast funding times and reports to credit bureaus, which can help build your business credit history. However, it’s important to note that OnDeck has a relatively high starting APR and borrower requirements.

e. Funding Circle: The Best for Established Businesses

Key Features:

-

Competitive starting APR for established businesses

-

Fast funding turnaround times, typically within 48 hours

-

Business credit bureau reporting and higher borrower requirements

Funding Circle is an excellent choice for more established businesses looking for a line of credit. While it has stricter borrower requirements compared to other lenders, Funding Circle offers competitive starting APRs, fast funding turnaround times, and business credit bureau reporting. If your business meets the eligibility criteria, Funding Circle can provide a valuable financing solution for your ongoing needs.

f. Honorable Mentions

While the aforementioned lenders stood out as the top choices, there are other notable options worth considering. Kabbage, Bank of America, Chase, Citibank, and Wells Fargo offer business lines of credit with various features and benefits. Kabbage, for example, provides monthly repayment schedules, while traditional banks like Bank of America and Wells Fargo offer low rates and high credit limits.

7. Alternatives to Business Lines of Credit

While a business line of credit can be a versatile financing tool, it may not be the best option for every small business. If a line of credit doesn’t suit your needs, there are alternative funding options available.

a. Personal Lines of Credit

If your business is relatively new or you have difficulty qualifying for a business line of credit, a personal line of credit can be an alternative solution. Personal lines of credit have fewer requirements in terms of time in business and revenue. They offer the flexibility of borrowing funds, but it’s important to note that they may have higher credit score requirements compared to business lenders. Additionally, some personal lenders may place restrictions on how you can use the borrowed funds, limiting their suitability for business purposes.

b. Traditional Banks

Traditional banks can be an attractive option for established businesses seeking lower rates and higher credit limits. Many banks offer both secured and unsecured business lines of credit, with collateral potentially lowering your interest rate. However, it’s important to consider that banks typically have higher application criteria, requiring businesses to be at least two years old and have credit scores above 700. If your business meets these qualifications, obtaining a business line of credit from a traditional bank can provide favorable terms, especially if you already have a business banking relationship with them. However, for many small businesses, alternative lenders may offer more accessible and flexible financing options, even if they come at a slightly higher cost.

8. Conclusion

A business line of credit can be a valuable financial tool for small businesses, providing flexibility, quick access to funds, and cost-effective financing. Whether you choose the top-rated Lendio, the flexible repayment options of Backd, the low rates of Bluevine, the perks for repeat borrowers with OnDeck, or the options for established businesses with Funding Circle, there is a line of credit solution to suit your specific needs. By understanding how a business line of credit works, its benefits, and the available alternatives, you can make an informed decision and secure the funding necessary to grow and sustain your business.