Digital finance has the potential to revolutionize the lives of billions of people in emerging economies. With two billion individuals and 200 million micro, small, and midsize businesses lacking access to savings and credit, the adoption of digital finance could be a game-changer. By leveraging mobile phones and the internet, digital finance has the power to transform the economic prospects of individuals, businesses, and governments across the developing world. In this article, we will explore the impact of digital finance in emerging economies and discuss the key conditions required to capture its benefits.

The Potential of Digital Finance

The McKinsey Global Institute (MGI) recently conducted a comprehensive study on digital finance in emerging economies. Their research revealed that widespread adoption and use of digital finance could increase the GDPs of all emerging economies by 6 percent, equivalent to a total of $3.7 trillion, by 2025. This boost in GDP is comparable to adding an economy the size of Germany or surpassing the combined GDP of all African countries. Moreover, this additional GDP could create up to 95 million new jobs across various sectors of the economy.

Benefits for Individuals and Businesses

The adoption of digital finance could provide access to financial services for 1.6 billion unbanked individuals, with more than half of them being women. Additionally, it could enable providers to offer $2.1 trillion in loans to individuals and small businesses by effectively assessing credit risk for a wider pool of borrowers. Governments could also benefit from digital finance, potentially gaining $110 billion per year by reducing leakage in public spending and tax collection.

Benefits for Financial Service Providers

Financial service providers would experience significant benefits as well. By shifting from traditional to digital accounts, providers could save $400 billion annually in direct costs, as digital accounts are 80 to 90 percent less expensive to service. Furthermore, by expanding their customer base, providers would have increased revenue opportunities and the potential to increase their balance sheets by as much as $4.2 trillion.

The Economic Potential of Digital Finance

The impact of digital finance varies across countries, depending on their starting position. Lower-income countries such as Ethiopia, India, and Nigeria have the highest potential, with the opportunity to add 10 to 12 percent to their GDP given their low levels of financial inclusion and digital payments. Pakistan, although having a slightly lower GDP potential at 7 percent, can still experience a substantial boost. Middle-income countries like Brazil, China, and Mexico could add 4 to 5 percent to their GDP, which is significant in itself.

The Importance of Digital Payments and Financial Services

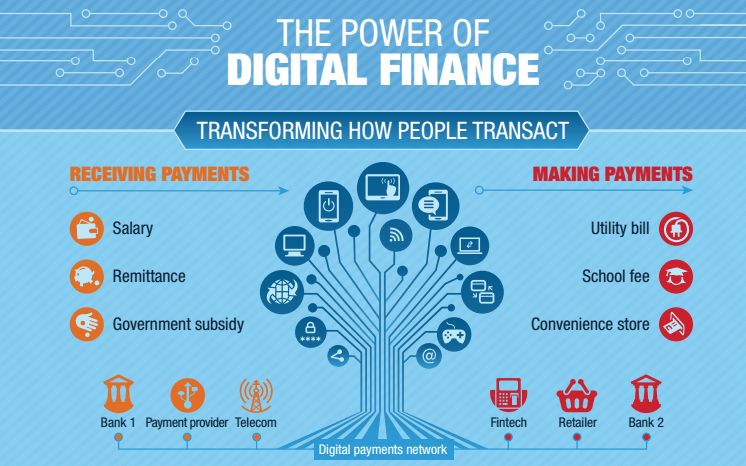

Digital payments and financial services play a crucial role in the modern economy. They enable individuals, businesses, and governments to transact cheaply and efficiently, contributing to economic growth. Various stakeholders, including banks, telecommunications companies, payments providers, financial-technology startups, and retailers, can tap into the potential business opportunities that digital finance presents.

The Role of Mobile Phones

Mobile phones are the game-changer that make digital finance accessible to a wide population. In 2014, almost 80 percent of adults in emerging economies owned a mobile phone, while only 55 percent had financial accounts. The majority of people in emerging economies have access to a network, and the coverage of 3G or 4G technology is continuously expanding. This widespread access to mobile phones and network coverage provides a solid foundation for the adoption of digital finance.

Capturing the Opportunity

To fully capture the opportunity presented by digital finance, businesses and government leaders must make a concerted and coordinated effort. Three building blocks are necessary: widespread mobile and digital infrastructure, a dynamic business environment for financial services, and digital finance products that cater to the needs of individuals and small businesses, surpassing the capabilities of informal financial tools.

Mobile and Digital Infrastructure

The first building block, widespread mobile and digital infrastructure, is critical for the success of digital finance. This infrastructure includes mobile networks, internet connectivity, and accessible digital platforms. Governments and private sector players must work together to ensure that the necessary infrastructure is in place to support the adoption of digital finance.

Dynamic Business Environment for Financial Services

A dynamic business environment is necessary to foster the growth of digital finance. This includes regulatory frameworks that encourage innovation, competition, and consumer protection. Governments should create an enabling environment that allows financial service providers to operate efficiently, while also safeguarding the interests of consumers.

Tailored Digital Finance Products

Digital finance products must be designed to meet the specific needs of individuals and small businesses. These products should provide a superior alternative to the informal financial tools currently used. By offering convenient, affordable, and secure digital financial services, providers can encourage widespread adoption and usage.

Conclusion

Digital finance has the potential to transform the economic prospects of billions of people in emerging economies. By leveraging mobile phones and the internet, individuals, businesses, and governments can access a wide range of financial services. The adoption of digital finance could result in a 6 percent increase in GDP for all emerging economies by 2025, creating millions of new jobs. Furthermore, it could provide access to financial services for the unbanked, enable sustainable lending, and improve government revenue collection. To capture these opportunities, stakeholders must invest in mobile and digital infrastructure, foster a dynamic business environment, and develop tailored digital finance products. By doing so, we can unlock economic opportunity and accelerate social development in emerging economies.